A few years ago, I was working with a software company on its lean transformation. During a training session, someone asserted that the company should charge higher prices to train new clients to cover their higher training costs. I opened a discussion on that statement, and the consensus was, “it takes us longer than our competitors to train new clients.”

I raised the point that the software company’s training costs are fixed – based on the number of trainers they have on staff. I then facilitated a quick “5-Why” exercise, and the primary root cause of why their training takes longer was the complexity of their software.

The thinking inside this software company was that the longer it takes to perform the training, the higher its costs. The same belief exists in manufacturing – the longer it takes to produce a product, the higher its costs.

The root cause of this thinking is based on traditional cost allocation methods, whether it be allocating training costs to a software implementation project, a complex tax return in an accounting firm, or a product being manufactured.

Under this thinking, each business would seek to reduce the time it takes to process the products or services to “reduce” costs. Or prices would be adjusted to “cover” the additional costs.

In Lean Accounting, we want to stop allocating costs based on time because it isn’t an accurate way to understand costs. To make this transition, financial thinking in an organization needs to change.

- Processing time creates value: Lean companies recognize that the time to produce a product or service is based on the value-added processing time (e.g., cycle time). Typically, the more value that needs to be created, the more time it will take resources (people and/or machines) to make the product or deliver the service.

- Waste adds to costs: Any of the seven wastes of lean adds costs to the business and increases lead times to produce products or services. Some costs may be direct, such as in manufacturing, where poor quality increases material costs. Other costs are less direct – a company hires more people than necessary because waste exists in the processes.

- Lean companies also recognize that the cost of the resources to the business is typically fixed. They understand that the business will incur these costs regularly regardless of the time spent on individual products or services. Lean companies make cost decisions based on long-term trends rather than which work must get completed today.

Calculating Accurate Labor Costs with Lean Financial Thinking

Labor costs are fixed based on how many people are employed. Companies hire more people based on total demand projections. Full-time, hourly employees work a 40-hour week, regardless of demand. Yes, a company may have temporary or part-time workers to bring in or send home based on demand, but usually, these are not the primary workforce.

Measuring the waste in a process and understanding the capacity of a process is what will impact labor costs. Employment of continuous improvement and other lean practices eliminates waste, improves capacity, and creates time. This time is then applied to value-added activities, which improves productivity and prevents lean organizations from having to hire additional people.

Lean organizations consider their employees to be their most important asset, which is counter to how employee cost is shown on the financial statements – as an operating expense. The second most important asset of a lean organization is time, which does not appear anywhere on financial statements.

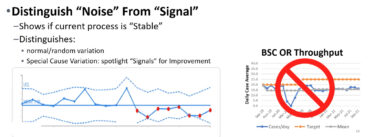

Lean organizations develop employees’ thinking so that they become experts in the difference between value-added activities and waste and have the skills to eliminate the waste daily. This work is done through observation and daily performance measurements.

Cost allocation systems, which are primarily used by managers, really work in direct conflict with daily improvement activities and measures. It’s essential for the financial leadership of every lean organization to eliminate the use of cost allocation methods.